Black Friday Games: iPhone Discounting Strategy

Ichel, F., Pettitt, P., Shumway, L., Khan, S.

One of the most critical days of the year for retailers is traditionally known in the United States as “Black Friday.” Black Friday is the day after Thanksgiving and signals the beginning of the holiday shopping season. Because of the importance of this shopping day, most companies have sales with many items heavily discounted in order to draw consumers into its stores.

This analysis focuses on retailers Black Friday discounting strategy of new Apple iPhones. The players in focus are Apple’s distinctive Apple Stores, WalMart, and Best Buy. The three retailers act simultaneously to make corporate plans in advance. Apple will decide to discount or not to discount; WalMart and Best Buy take discounting as a given but must decide whether to discount high or low. Traditionally, about 65% of iPhones are sold through wireless carriers, the remaining 35% are split between Apple stores (14%), Best Buy (14%), and other mass retailers (7%), with Walmart accounting for half that number (3.5%).

In this case Walmart, Best Buy and Apple are each making a simultaneous decision about how they will price the iPhone on Black Friday. Apple Stores offer the best customer service and experience for consumers willing to pay premium prices and focus only on Apple’s products. Historically, Apple has been judicious with small discounts if any. The case for Best Buy and WalMart, however, is not whether to discount, but to what extent? Consumers are well informed as to where they can find the holiday’s hottest items for cheap, so the fight for all-important foot-traffic is related to who discounts deeper.

To establish that this game is played simultaneously, it is assumed that corporations must pre-plan their inventory, working capital, and advertising promotions before they can expect to hear what competitors have announced. The rationale is that by the time consumers start establishing their shopping plans for Black Friday, it is too late to change the marketing copy which will be prepared for distribution.

Each retailer has different strategies to thrive within particular constraints and opportunities, and subsequently, each will have a unique approach and different desired outcomes on Black Friday. Apple’s most desired outcome is that consumers view Apple iPhones as premium products, and are willing to pay a premium price for them. Second, Apple is concerned with maximizing its profits on Black Friday. Lastly, Apple would like customers to purchase iPhones in Apple stores because 1) higher margins, 2) increased sales of ancillary products, and 3) exposure to the in-store atmosphere, which leaves consumers with a desire to return. An unfortunate result of premium pricing is to limit the addressable market to high-income segments (even the iPhone 5c was priced aggressively at $550 in 2013, only $100 less than the superior iPhone 5s). Apple effectively uses retail channels like Walmart and BestBuy to price discriminate, or offer lower prices to a targeted consumer segment which is more price conscious, and therefore less likely to start shopping in an Apple Store. Customers walking into an Apple store are likely to be Apple fans excited to get their hands on premium products, and they are willing to pay a premium. But even these fans could be swayed to another retailer for a lower price. Also, these retailers attract massive foot-traffic which gives the iPhone increased opportunities to tempt customers, which is especially important during Black Friday, where the sale window puts constraints on consumers time. Since Apple likely gives retailers only 10%-12%1 margin on each iPhone sold through those channels, most of the margin still accrues to Apple, so Apple’s main goal is to maximize sales by building a userbase of high-paying iPhone customers.

Walmart’s desired outcomes for Black Friday differ from those of Apple. Walmart stands out in consumer minds as a low-cost leader; thus when visiting Walmart, they expect the prices to be lower than anywhere else. The same expectations are maintained on Black Friday; I.e., consumers expect Walmart to have more significant discounts than anywhere else. Walmart’s primary goal for Black Friday is to get as many customers in the door as possible, and it does this by steeply discounting popular items. A loss-leader can pay-off by driving sales of high margin accessories and other goods.

Best Buy believes maximizing customer traffic would be ideal. However, it does not want to upset the supplier (Apple) by discounting too much, as they have less bargaining power. Additionally, a deeply discounted iPhone may cannibalize sales of higher margin phones for Best Buy. Consumers entering Best Buy already have it in mind to shop for electronics such as smartphones, where there are dozens of competitors, so there is significant cannibalization by the discounted product. Also, Best Buy could face pressure in the form of marketing dollars from Samsung and other competitors to promote their product more aggressively than the iPhone.

In this simultaneous play game, Apple is choosing between discounting the iPhone on Black Friday and offering no discount. It is not realistic that Apple would offer a high discount. Walmart and Best Buy are choosing between offering a low discount and a high discount on the iPhone for Black Friday. It is not realistic that either would not offer a discount and indeed they have done so in past years. The current dilemma then, is how the pricing strategy would affect the outcome of iPhone sales for each respective retailer as well as their respective goals detailed above. Given the situation at hand, the players must decide ahead of time what they will do on Black Friday, thus changing their mind last minute is not an option due to a high likelihood of sunk costs on preliminary promotion. Each player does not know what the other will do until a few days before the event, and by that point, it will be too late to change anything, thus making it a simultaneous play game.

Payoffs were determined by ranking each firms’ options from most to least desirable. The rankings and subsequent payoffs took into account each firm’s goals detailed above as well as how they would prioritize those goals. For example, Apple would prefer that customers purchase iPhones in Apple stores due to the higher margin and increased sales of ancillary products. However, that goal is less important than maintaining brand equity and premium perception. As such, the payoffs and rankings will reflect that Apple will prefer a strategy where a premium is maintained over one which maximizes sales of iPhones in their branded stores, all else being equal. Furthermore, the interplay between the goals was accounted for. So, while Apple wants to maximize Black Friday sales, there is a realization that maximizing Black Friday profits could result from higher supplier sales to Best Buy and Walmart as they discount the models, while not discounting at Apple stores in order to maintain brand equity, knowing that that strategy will result in low iPhone sales in Apple stores.

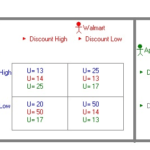

The game is set up in Game Plan as a three player simultaneous game where Apple either discounts or does not discount, and Best Buy and Walmart either highly discount the iPhone or discount at a lower rate. The setup, with all eight sets of payoffs, is shown below:

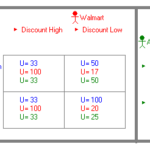

When the game is run, there are two Nash equilibria. In the first, Apple does not discount, Walmart discounts high, and Best Buy discounts low. In the second, Apple still does not discount, while both Walmart and Best Buy both discount high. The two solutions are shown below:

Both equilibrium strategies make sense from a business perspective. Apple never discounts, because the priority is maintaining brand equity, premium status, and can reach price discerning segments by supplying Best Buy and Walmart, who are motivated to discount. In the first solution, Walmart discounts high and Best Buy discounts low. This reflects the fact that Walmart makes its name off of low prices selling anything and everything, while Best Buy focuses on consumer electronics and sells competing smartphone brands and must consider cannibalization of higher margin phones when running promotions. In the second equilibrium, Best Buy also discounts high, matching Walmart, due to a need to drive foot-traffic and sales on Black Friday when a significant portion of consumer holiday money is spent. Best Buy is equally happy with discounting high or low and the payoffs are the same, though those payoffs reflect differing goals.

In reality, the past few years have seen the realization of this game as the retailers approach Black Friday. Apple never discounts the iPhone in its branded stores, while Walmart tends to run the deepest promotions and runs them dependably. Best Buy takes a stance in the middle, sometimes offering low discounts and other times offering a discount which matches Walmart’s. This game and the thought process through the payoffs gives insight into not only their business decisions but also their goals and what factors influence their payoffs. The key insight gained here is that Apple’s channel strategy allows for brilliant segmentation to meet consumer’s willingness to pay. This allows Apple to have it both ways – preserving the Apple store value in the mind of loyal consumers while offering a cheaper way to dip a toe into the stripped-down Apple experience.

In future analysis, it would be interesting to consider the implication of one retailers’ business model adapting to delay determining its strategy until after observing competitors move first. In such an extensive form game, the hypothesis to test is whether the last mover is better off than in the simultaneous game.

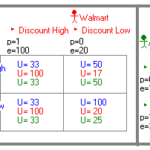

When we explore how changes in critical payoffs affect the outcome of the game in equilibrium, we note some peculiar findings. A sensitivity analysis focusing on two key assumptions could in fact change the game significantly for the players at hand. In our first assumption, Apple’s primary focus is on brand equity. If instead, we assume Apple’s priority is to increase sales through Apple Stores, we adjust our payoffs to favor outcomes; thus shifting the focus to sales volume, we see that Apple would, in fact, go for the discounting strategy. Particularly the most attractive outcome for Apple is to discount while other retailers are discounting low, to be competitive on price. The segmentation of the channels still benefits each company by reaching different customers.

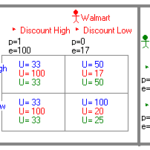

Our second key assumption to question is margins for the retailers. While retailers normally receive a 10-12% margin on the iPhone, if that number was significantly lower, it would change whether mass retailers would continue to discount the iPhone high and take a loss. In our second analysis, we assumed very low margins on the iPhone (2-3%), and the results indicate that loss leaders such as Walmart would still be inclined to discount high, while Best Buy would always choose to discount low. The implications this has on the business case show that Walmart would still benefit from the increased foot-traffic, while Best Buy would not only lose money on sales of the iPhone but severely cut into the sales of it’s other higher margin phones. Under these priorities, discounting high would always be a bad decision for Best Buy.

A third assumption to tweak is Best Buy’s fear of cannibalization of other phones. If we relax this concern and instead assume high discounts will increase foot-traffic and increase ancillary purchases at Best Buy, then Best Buy’s motives would be more similar to that of WalMart.

Sensitivity Screenshots